Africa Consumer Report. Picture: Supplied

A new report has revealed that Africa’s Gen Z consumers are reshaping the continent’s retail future.

Boston Consulting Group’s (BCG) ‘119 Million Reasons for Optimism’ report highlights how Africa’s digital-first Gen Z is driving a retail revolution across the continent despite the toughest consumer climate in years.

Retail reset

According to the report, Africa’s youngest consumers are powering a potential retail reset that blends digital discovery with hyper-local focus, redefining what it means to consume, connect, and aspire.

The BCG survey details why the continent’s 119 million Gen Z consumers across six surveyed countries (aged 18 to 27) are poised to become the primary growth engine for African retail over the next decade.

Survey

A survey of 6,000 urban consumers across Egypt, Morocco, Ethiopia, Nigeria, South Africa, and Kenya places consumer sentiment at -23%, the lowest since BCG began tracking it in 2018.

It highlights that three-quarters of Africans consistently worry about their finances; more than half are saving less, and nearly a third report lower household income than six months ago.

While most consumers expect to spend more, responses indicate that spending growth is inflationary rather than driven by choice.

The future

Gen Z defies this trend by displaying confidence about the future. “This is a story of hope under strain,” said Thomas Jensen, Managing Director and Senior Partner at BCG Nairobi and co-author of the report.

“Yes, Africa’s consumers are facing tough economic headwinds, but with 70% of Gen Z expecting their financial situation to improve in the next year, their optimism is already shaping what, how, and why Africa buys.”

Demographic

According to the report, Gen Z’s optimism carries demographic weight.

In the six surveyed markets, Gen Z already comprises 119 million people, or 18% of the population, and is expected to grow to 167 million by 2050, signalling a youth bulge.

This “youth bulge” is not merely a demographic fact but a transformative market force. “Gen Z’s optimism and digital fluency are reshaping Africa’s retail landscape,” added Zineb Sqalli, Managing Director and Partner at BCG Casablanca, co-author of the report and Africa node lead for BCG’s Consumer Practice.

“We’re seeing how they blend local trust with global aspiration, moving fluidly between online discovery and offline fulfilment.”

Digital payment

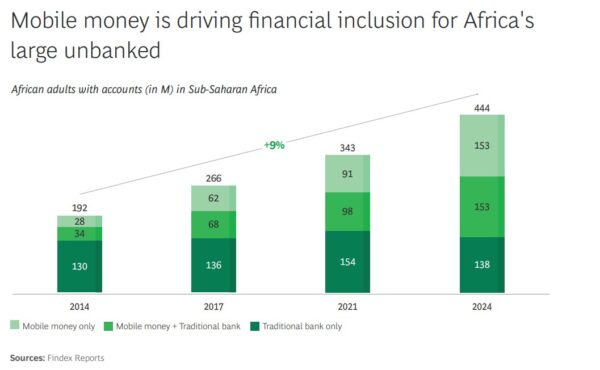

According to the report, this retail revolution is closely tied to the continent’s digital payment boom.

“With smartphone penetration projected to reach 87% by 2030 and 60% of adults now holding a financial account, the foundations for inclusive, scalable commerce are being laid. The rapid adoption of mobile money and fintech solutions means young Africans are not only more likely to interact with brands digitally but are also leading the way in credit adoption.”

NOW READ: Holly Rey launches ‘Wear It Forward’ to support children Living with Type 1 Diabetes

Opportunity

BCG said for business leaders, the opportunity is clear

“The time to act is now. Gen Z’s habits and loyalties are being formed today, and brands that embed themselves in their digital lives, offer responsible credit, and connect online discovery with local fulfilment will earn lasting trust.

“The growth play for consumer companies is to build relevance, trust, and access for Gen Z and youth by balancing affordability with aspiration, treating social media platforms like WhatsApp, TikTok, and Instagram as direct commerce channels,.

“The real opportunity is not to bet on a sudden consumer boom in Africa,” said Vishakha Chopra, Project Leader at BCG. “It is to build relevance and trust now, as this generation earns, aspires, and grows into economic influence.

Investment

BCG said African Gen Z is a formidable demographic force that is forming the loyalties that will define the next 30 years.

“Companies that invest in them early will capture both growth and lasting influence.”

ALSO READ: Black Friday: This is how to spot a true bargain from a clever scam